FMDS 2021

With the development of the country and the increasing needs of customers for financial services, Macedonia is facing rapid expansion in the financial sphere. Because of this, there is a need for a functional tool that will provide basic information thereby facilitating the orientation of the financial market. Indago continues to monitor the development of the financial market in Macedonia in 2021, a research that has been conducted continuously since 2008.

Development of the banking sector in Macedonia

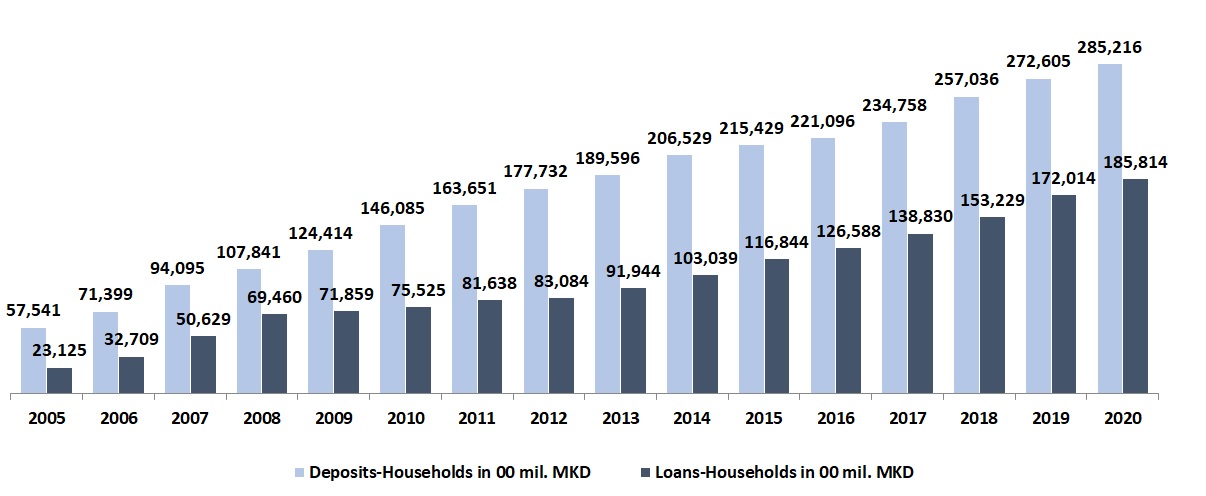

Both deposits and loans among households are steadily growing in the monitored period (from 2007 to 2019). According to the National Bank data in 2019 the deposits reached 272.605 million denars and the amount of loans to households amounted to 172.014 million denars.

Households – Deposits and Credits

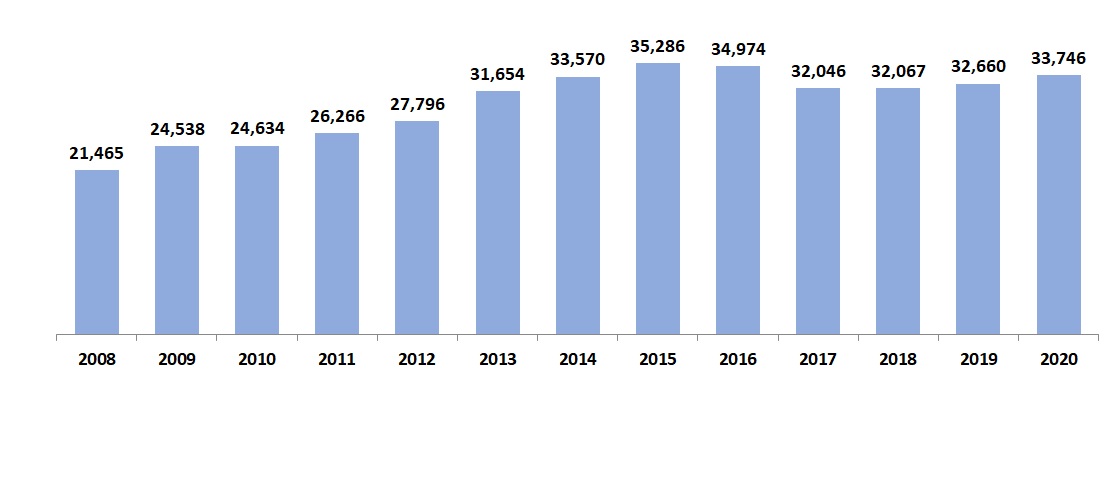

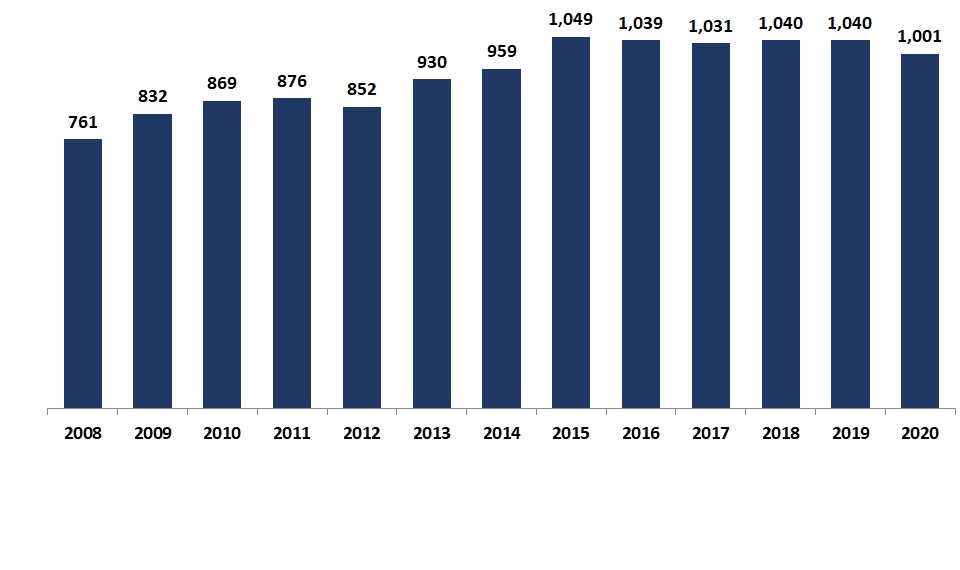

The number of issued payment cards, point of sales terminals and ATMs has reached its peak in 2015 and since then the market has flattened. According to the data from National Bank the highest number of registered POS terminals is in 2015 (35.286) and since there is a declining trend and at the end of last year there are around 10% less POS terminals than in 2015. The same is with the number of issued payment cards and installed ATMs.

Number of POS Terminals

Number of ATMs

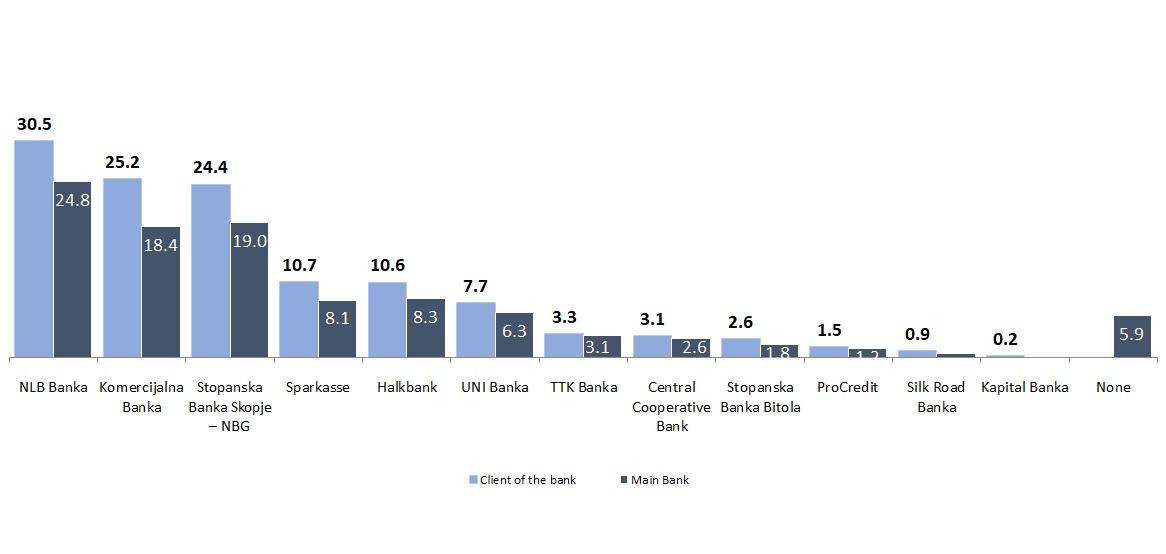

According to the survey results 94% of population 15+ years old has a relation with a bank. The big three banks – NLB Banka, Komercijalna Banka and Stopanska Banka AD Skopje have the highest shares of customers, followed by Sparkasse Banka Makedonija and Halkbank.

Methodology note

As part of its regular annual survey about the financial market, Indago conducted a syndicated survey – Financial Market Data Services (FMDS). The survey was conducted on a nationally representative and proportional sample of respondents aged 15+. The sample is representative by age, gender, region and proportion of urban/rural areas. The sample size was 1,001 respondents and data were collected via CAPI interviews in the homes of the respondents in the period between 01 October to 17 October 2021.

Why use FMDS:

- If you want to have information on financial services usage in the country

- To help you understand what are the strong & weak point of banks from customers point of view

- To identify the most important criteria when choosing a bank

- To understand sources of information used when making decision for financial products and services

For more information please contact: boge.bozinovski@indago.mk